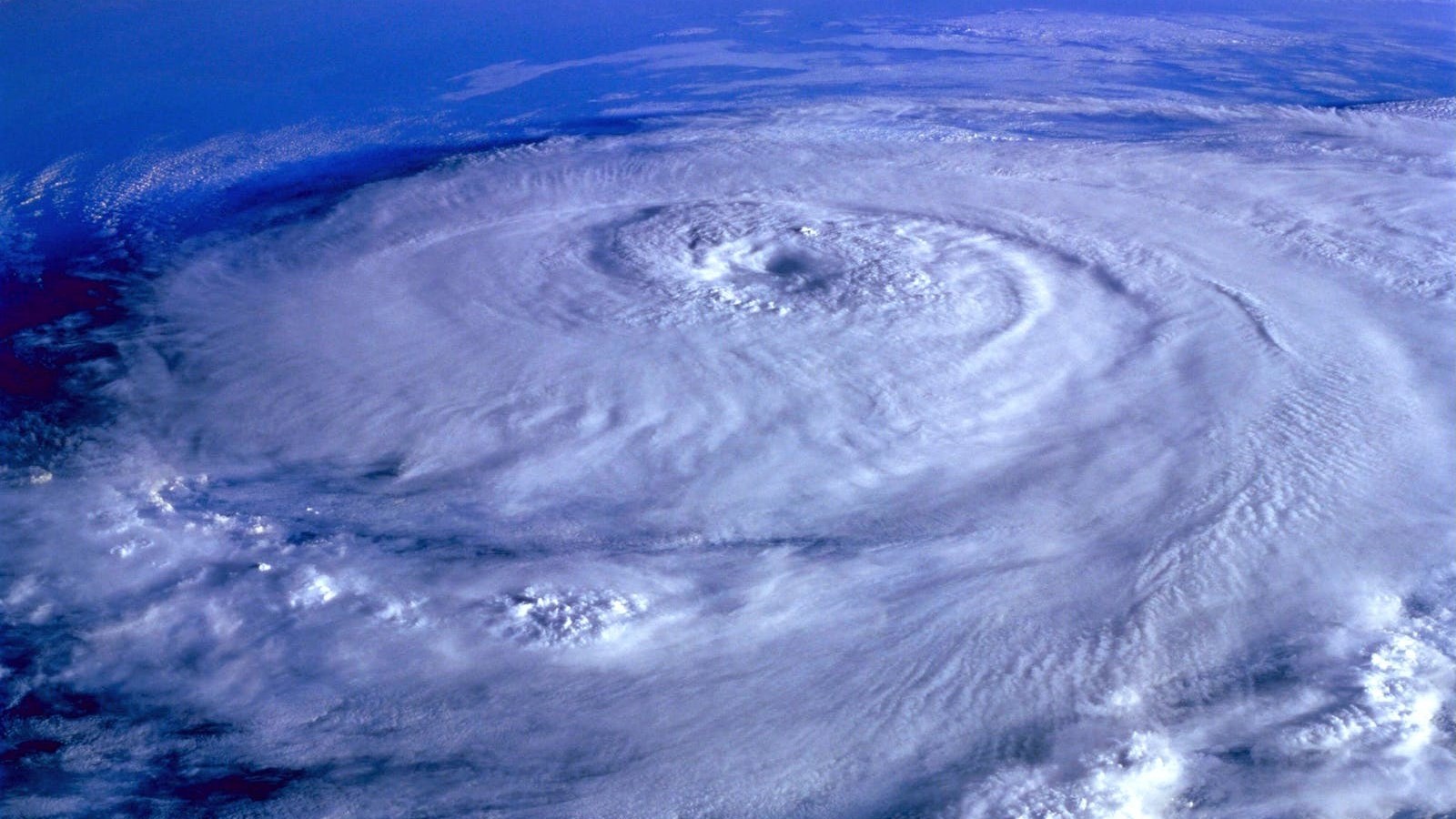

Buying in natural disaster areas with eyes wide open

___

Published Date 5/31/2024

Sometimes it’s hard to believe that places as beautiful as Florida or as stately as North Carolina hold the potential for disaster. But at the start of hurricane season in the Southeast, this year’s storm forecast looks to be one of the worst on record.

Realtor.com’s June Gerstein cites the National Oceanic and Atmospheric Administration 2024 hurricane season report — released last week – that warns that the Atlantic Ocean is currently at temperatures that are typically not seen until August. As a result, it anticipates that this could lead to between 17 and 25 total named storms with winds of 39 mph or higher. It predicts that four to seven of those will be Category 3, 4, or 5 major hurricanes with winds of more than 111 mph.

The news has set off its own flurry of concern, with media outlets such as the Miami Herald fretting over how this forecast is the one of the worst ever issued. So why would anyone dare to live in a hurricane-prone area at all?

“For many homebuyers, climate concerns loom like a dark cloud as they navigate where they want to live,” says Gerstein, citing a 2024 Realtor survey that says 70% of homeowners and sellers consider the potential impact of natural disasters and climate events while they’re purchasing a home. “Just under half even said they let climate events determine where they would move.”

And they would have good reason to be concerned. In 2024, approximately 18.1% of homes in the country face potential damage from wind events like hurricanes and tornadoes, with cities like Miami and Kay West facing a 16% chance of getting hit every year. This is followed by Cape Hatteras, NC (15%), Tampa, and New Orleans (both 11%). Even though Florida holds three of the top five spots at risk of hurricanes, it still continues to be one of the most popular places to move, however. Just last year, Florida boasted four of the five fastest-growing cities in the U.S.

Lifestyle and natural beauty. That’s what draws them, according to Realtor economist Jiayi Xu. “In addition, Florida has a diverse economy that offers numerous job opportunities, a draw to many. Furthermore, Florida is one of the few states with no state income tax, which can be a significant financial advantage for residents. Additionally, property values in Florida tend to appreciate consistently over time, making buying property here a potentially good investment.” Plus, not all of Florida is at risk. It varies by area.

“Choosing a property in regions less prone to severe hurricanes can mitigate risk,” points out Xu. “Realtor.com provides property-specific environmental risk scores, which include hurricanes and floods. Prospective homeowners can leverage these scores to gauge climate-related risks across various locales, aiding them in pinpointing ‘safer’ areas prior to finalizing their choice.”

Gerstein reports that between 1851 and 2022, 120 hurricanes hit Florida. Northeast Florida had the least number of incidences, with only 28 hurricanes, compared with 48 in Southeast Florida, 51 in Northwest Florida, and 66 in Southeast Florida. So some agents recommend moving to Central Florida or the northeastern part of the state if hurricanes are a concern — cities like Orlando, Leesburg, Kissimmee, and Lake City, considered “safer.”

“The only really safe area is one in which they don’t have those kinds of storms—which would be more toward the Western region of the country or the desert communities, of course,” says FL-based agent Cara Ameer. “Going inland is certainly a bit better. But even those areas can be low-lying and prone to flooding, so that’s not always a guarantee.” Ameer says she knows of people who’ve lived inland and experienced more damage in certain storms than others. And Orlando has encountered its fair share of damage as storms often crisscross the state, she adds.

Lenders as well as insurers can be cautious. “I was in the middle of a few transactions during two major hurricanes whereby the buyers were buying homes and their lenders wanted an inspection to verify there was no damage to the home that could materially affect their ability to get a loan,” Ameer recalls. “We sent back the home inspector in those cases to evaluate the properties and look for any signs of damage, wind-driven rain, roof damage, leaks.”

Wherever you’re home shopping, understanding the environmental risks you’ll encounter can help you make smart decisions about where to buy. Check out those “risk scores” and maps to illustrate a home’s risk exposure to floods, extreme heat, hurricanes, and wildfires. See if the property is in a flood zone, and if so, is it in a zone requiring flood insurance, gauges the proximity to any kind of water besides just the ocean—lakes, streams, rivers, canals, manmade ponds—as these can all overflow, could potentially impact the property where it is located, Ameer explains. “You also want to see if the property sits on or near a marsh or any kind of tidal waterways.”

“Ask the sellers of any homes you are considering if they had any prior issues with flooding or water intrusion, and get details on what caused that,” Ameer continues. “You also want to check the insurance history on the home and see if there had been any prior claims filed due to water damage or storms. If you are buying in an area that has experienced tropical storms and hurricanes before, you should talk to the neighbors in the community where you want to buy to see what their experience was like going through the storm.”

Stormproofing? No small issue. “Ask if the properties you are considering have any hurricane shutters as well as any particular stormproofing,” says Ameer. “Also examine the proximity to trees to the property as these can become uprooted or wind can cause damage to them.” But if you can’t resist moving to a hurricane-prone area, Flynn also recommends investing in an independent generator.

Realtor, TBWS

All information furnished has been forwarded to you and is provided by thetbwsgroup only for informational purposes. Forecasting shall be considered as events which may be expected but not guaranteed. Neither the forwarding party and/or company nor thetbwsgroup assume any responsibility to any person who relies on information or forecasting contained in this report and disclaims all liability in respect to decisions or actions, or lack thereof based on any or all of the contents of this report.

Chris A. Heidt

NMLS: 38412

Northpointe Bank

8660 College Parkway, Suite 150, Fort Myers FL

Company NMLS: 447490

Cell: 239-470-6310

Email: cheidt@heidtfinancialllc.com

Chris A. Heidt

___

NMLS: 38412

Cell: 239-470-6310

Last articles

___

Stale listings; Diamonds in the rough?

6/17/2024

There’s a buyer for every home. Or is there?... view more

Three things that could impact rates this week

6/17/2024

These are the three areas that have the greatest ability to impact rates this we... view more

Markets expect a calmer week ahead

6/17/2024

It is a short week with markets closed on Wednesday for Juneteenth. The calendar... view more

What happens when you grow up but your furniture doesn’t?

6/14/2024

When the scale of your furniture reflects IKEA instead of...... view more

Both Import and Export prices decreased in May

6/14/2024

At 8:30 am ET more good news on May imports and export prices. Imports expected ... view more

Looking beyond a kitchen’s glamor

6/13/2024

Kitchens are arguably today’s house jewelry — often the part of the house that m... view more

The May Producer Price Index beat expectations by contracting

6/13/2024

The May headline Producer Price Index (PPI) contracted by -0.2% versus estimates... view more

Pickleball right in your own backyard? Why not?

6/12/2024

Pickleball. The sport became a thing in the summer of 1965, when its founders...... view more

Markets get a boost on lower than expected Consumer Price Index

6/12/2024

The improvement in rates began yesterday on the very strong 10 year note auction... view more

Load more

Northpointe Bank

Northpointe Bank